The Best Strategy To Use For Financial Advisors Illinois

Table of ContentsThe Greatest Guide To Financial Advisors IllinoisExamine This Report on Financial Advisors IllinoisFinancial Advisors Illinois - QuestionsThe Basic Principles Of Financial Advisors Illinois What Does Financial Advisors Illinois Mean?The smart Trick of Financial Advisors Illinois That Nobody is DiscussingAll About Financial Advisors Illinois

That is always a hard inquiry to address due to the fact that it entails a mix of quantitative and qualitative factors. There is the fundamental problem of consultant skills and certifications.It is a partnership of trust and you require to nurture it over a duration of time. 10 Top qualities you have to search for in your monetary advisorYou needs to try to find a mix of measurable and qualitative consider your monetary expert. Above all, also concentrate on the emotional ratio.

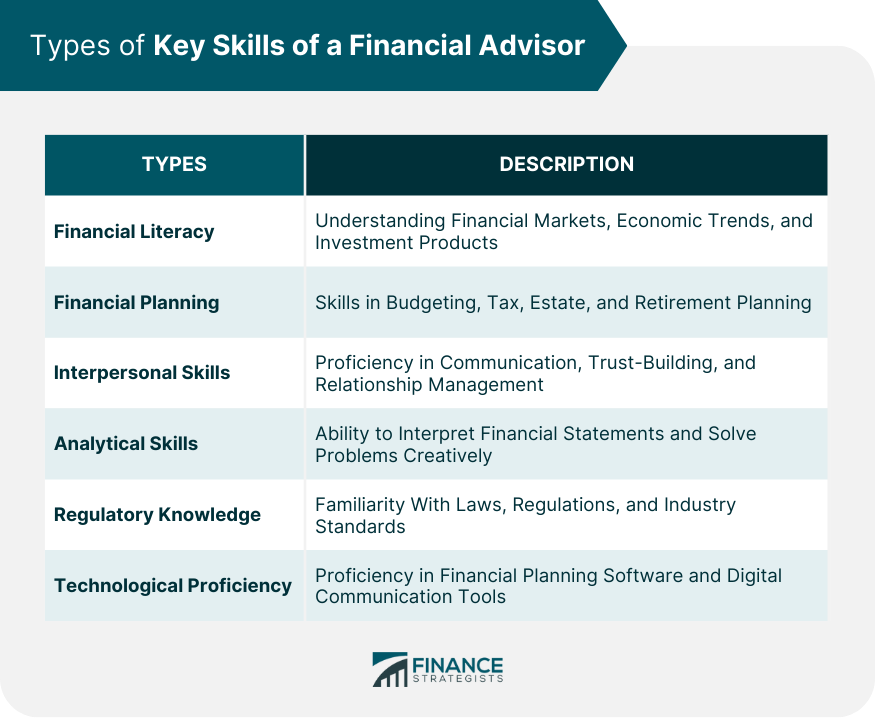

Try to find appropriate academic qualifications. You can suggest that official education and learning is not everything yet you require to focus on this facet for 2 factors. Firstly, an official education exposes you to big body of knowledge that includes products and methods. A formal education and learning instils rigor in a monetary advisor and the a lot of fundamental quality you are looking for in your expert is the rigor to deal with mountains of information and make feeling of the same.

4 Simple Techniques For Financial Advisors Illinois

2. Try to find their track record on the market. You can constantly dig around and ask individuals who are extra going to share information. Remember, good track record and bad credibility typically comes before economic experts in the marketplace. A great reputation is important due to the fact that you are entrusting your monetary futures and definitely desire a person that is fairly above board.

Is your financial consultant aggressive? This is a qualitative reasoning but you can construct out in 2 or 3 sittings with your consultant. A monetary consultant can not be awaiting a crisis and after that react to it. You need a positive consultant who measures the risk beforehand and as necessary modifies your profile mix.

5. Make certain that your monetary consultant does not have any type of conflict of rate of interest. Look into 2 points below. Is your expert billing you costs or is he gaining compensations from principals for selling their products. The previous is a much better circumstance to have also if it implies higher costs. Second of all, inspect if the advisor is likewise dealing with other players in the financial sector as a consultant.

Is your economic expert having a full assistance team with advisors, experts and executives? At the end of the day you need options not just working as a consultant from your consultant.

Financial Advisors Illinois Can Be Fun For Anyone

Also much dependence on one individual is not a great concept. Is the consultant making you the centrepiece of the whole discussion? You do not desire a consultant who spends even more time clarifying products and benefits (Financial Advisors Illinois).

We use cookies on our internet site to provide you the most relevant experience by remembering your preferences and repeat visits. By clicking "Accept", you grant using ALL the cookies.

Recognizing just how your expert is paid ensures that their motivations line up with your best rate of interests, fostering a relied on, clear partnership. Moreover, it's essential to make sure that your monetary expert has the appropriate credentials and experience. Certifications like Licensed Monetary Coordinator (CFP), Chartered Financial Analyst (CFA), and various other specialist classifications demonstrate an advisor's commitment to adhering to industry criteria and maintaining their know-how.

The smart Trick of Financial Advisors Illinois That Nobody is Discussing

That's why Select Advisors Institute is the leading selection for exec visibility training. Right here's why: Customized Management Coaching for Financial Advisors: At Select Advisors Institute, we don't supply one-size-fits-all training. Instead, our technique is personalized see to the special needs of economic consultants. We focus on helping them fine-tune their individual management top qualities, communication style, and ability to influence clients.

As a financier, the secret to selecting the ideal economic expert is finding somebody who not only has technical competence yet additionally the capability to connect with authority and lead with self-confidence. If you're seeking a monetary consultant that has exceptional management skills, search for one who has actually undertaken executive existence training.

SEO Meta Summary (110 words): Looking for a trusted economic expert? Executive presence is key. Select Advisors Institute offers # 1 exec existence training for monetary leaders, helping them establish the leadership abilities required to communicate with clearness, self-confidence, and authority. Our tailored coaching improves both in-person and on the internet client communications, enabling advisors to build trust and foster strong relationships.

At Select Advisors Institute, we believe that one of the most trusted financial advisors are those who demonstrate not just outstanding technological acumen yet additionally the leadership qualities that instill self-confidence and depend on. Below's just how to examine whether somebody is absolutely the right fit for you and why executive presence plays an important role in the assessment.

The 15-Second Trick For Financial Advisors Illinois

Here's why: Self-confidence: A financial consultant with exec visibility shows a sense of self-confidence and calmness, even in high-pressure scenarios. Clarity: Great advisors are outstanding communicators.

Furthermore, consider their track record; ask for customer endorsements or evaluations to determine their success in assisting investigate this site clients achieve financial objectives. In addition, the compatibility between an investor and their expert plays a critical function that site in the advisory connection (Financial Advisors Illinois). A reliable economic advisor must show outstanding interaction abilities, proactively pay attention to your requirements, and tailor techniques that line up with your monetary objectives

The Main Principles Of Financial Advisors Illinois

Additionally, examine their experience in the financial industry and whether they have actually handled customers in circumstances comparable to your own. An all-around advisor should not just have the technical knowledge yet likewise the social skills to direct you through facility economic choices with self-confidence. In your search for a relied on financial expert, don't ignore the relevance of a clear charge framework.

Remember that a genuinely leading rated consultant prioritizes your ideal rate of interests most importantly, offering impartial guidance and showing stability throughout the partnership. By taking an extensive technique and keeping open discussion, you equip yourself to make smarter financial choices that straighten with your life goals (Financial Advisors Illinois). If you have concerns or want tailored aid, don't think twice to get to out

What kind of monetary expert should I choose for retired life preparation? Just how do I locate a relied on financial advisor near me? What inquiries should I ask an economic consultant before hiring?

Things about Financial Advisors Illinois

When examining potential experts, pay attention to their experience with clients whose monetary circumstances resemble your very own, their approach to take the chance of monitoring, and their readiness to educate you concerning financial investment alternatives and market conditions. Guarantee they stick to a fiduciary requirement, indicating they are legally needed to act in your finest passion at all times.

Exactly how do I locate a financial consultant near me? 2. What questions should I ask a monetary advisor prior to employing? 3. Exactly how to verify a financial consultant's qualifications and history? 4. What is the difference in between a fiduciary and a non-fiduciary consultant? 5. How a lot does an economic advisor price? 6.